Take control of your financial life

Get ready for a new personalized banking experience right at your fingertips. Pay bills, send payments, make transfers, and do more - in minutes, with just a few clicks!

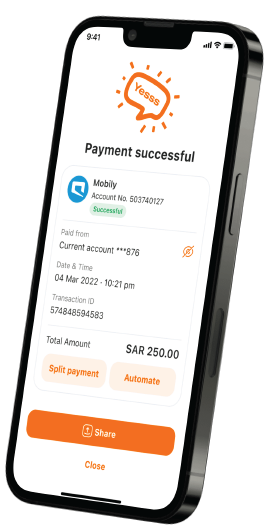

Pay your bills

We’ve partnered with SADAD to allow you to make seamless payments for all your bills.

Set up automatic payments for bills

This feature allows users to settle any of their bills from any account they select, thereby ensuring the payment happens automatically and seamlessly on the day chosen for payment.

Fast, free and secure money transfers

Whether you want to send money or receive money, you can do it in a blink! Just enter a recipient’s IBAN. We will do the rest.

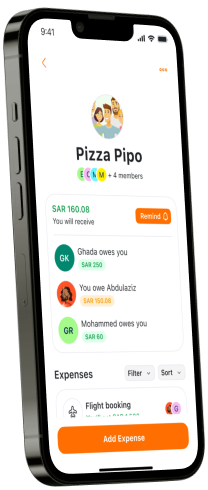

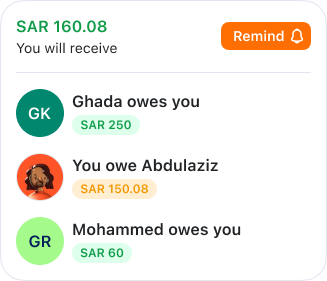

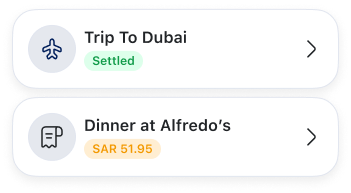

Qattah

Qattah is a tool that helps you Keep track of your shared expenses and balances with housemates, trips, groups, friends, and family.

You will be able to add expenses manually or fetch from your transactions history and split them among the Qattah members.

You will be able to settle your dues, remind the members to pay you and mark the expenses as paid. With iz smart engine, the expenses will be simplified.

Manage Your Money - Your Way

Optimize your savings and set money aside for what matters most. Our Saving goals sub-accounts comes with boosters to help you save smarter, faster than ever — at no extra cost to you.

.png?la=en&h=224&w=447&hash=AC525A926167DAD50137B07AEC892372)

Personal Savings

Get a head start on your future and start saving. With a simple savings sub-account that offers benefits that help kick your goals into high gear.

.png?la=en&h=225&w=447&hash=73816F9107D0BE76BC40EC7222B398F5)

Shared Savings

The more the merrier. Iz provides a solution that enables saving with partners, family, friends to help keep everyone on track with an eye toward their saving goals.

.png?la=en&h=312&w=624&hash=A28F9713E745AB8722685D32EB7B0CA1)

The Emergency Jar

Iz makes putting away money a priority with our Emergency Jar, so you’re always ready for life’s curveballs. We’ll set up your Emergency Jar on day 1 and help you stash away money over time.

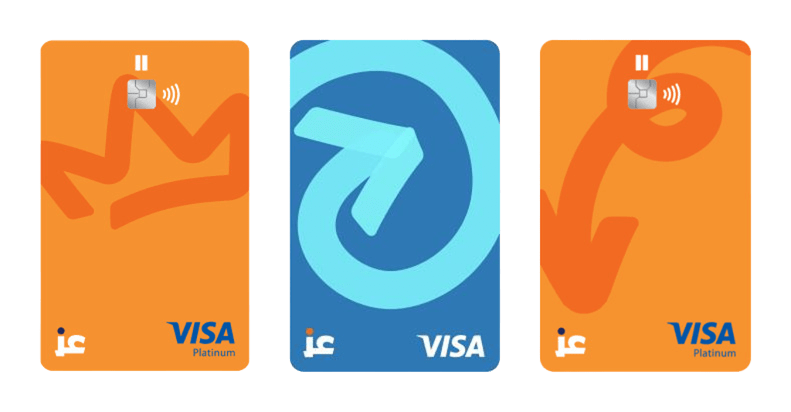

The card that has your back!

Never postpone a trip, purchase or outing again! We’ve made borrowing more accessible for everyone. With only a few simple steps, and one minute of your time, you can now get you credit card from Iz! No lengthy forms. No salary transfer. Nothing! What more? Your credit card will be immediately issued digitally and we will deliver the physical one to your doorstep.

cash from ATMs

Banking

For the first time in Saudi!

.svg?la=en&hash=45E28CE38825993E047C240CF7692A34)

Credit Cards

For Students

With Iz Credit cards, students and young professionals can learn to spend, save, and manage their money and get the financial freedom they crave with the security and visibility that they want.

We created the perfect resources to help jumpstart your financial journey. After all, the better you manage money, the better you grow money.

.

iz Cashback

Card

A Card with 1% cashback on all your local and international transactions, starting from 1 SAR with no minimum spend required.. Digital, instant, and FREE!

Professional Credit Card

We designed it to match your ambitions at the beginning of your career journey! A card that offers you flexibility in managing your personal and business expenses, helping you with financial planning and achieving your goals professionally. It also gives you "akthr" points with every payment transaction. Issuance is easy and digital!

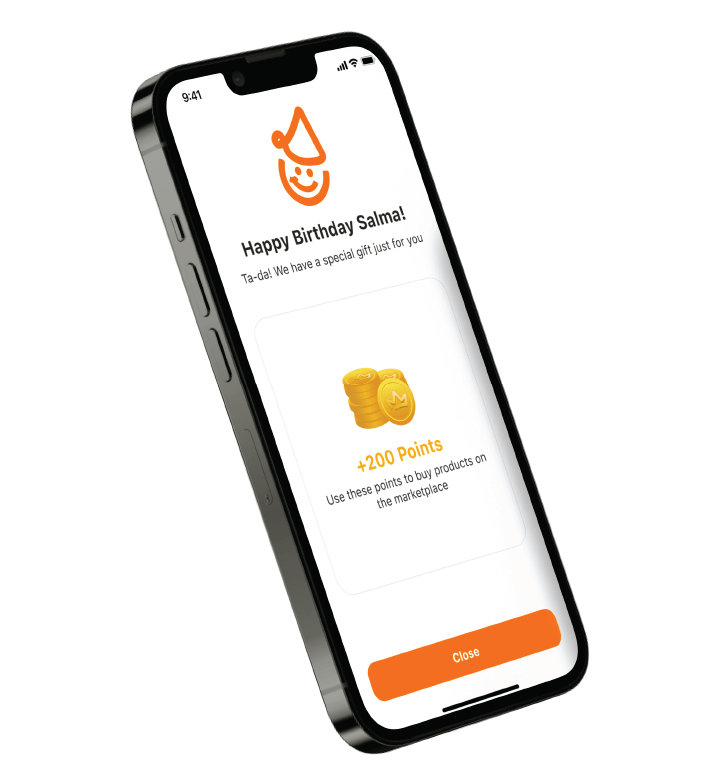

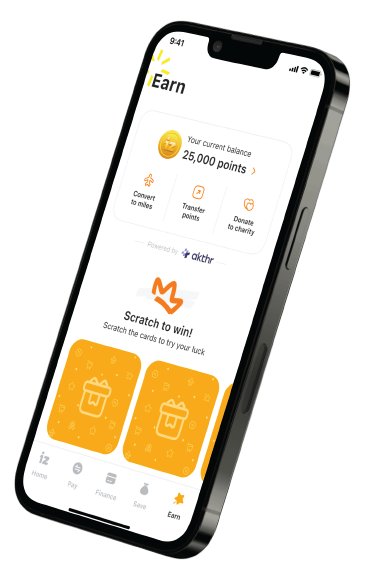

Earn. Collect. Redeem

Using Iz is rewarding, in more than one way.

Keep earning Akthr points, using the features you love through the app, inviting your friends to join your groups and more.

The more you spend, the more you earn.

Cha-ching, it’s time to get rewarded! Once you have collected enough Iz points, redeem them in the app for instant rewards like gym subscriptions, Uber rides to free rides, and more.

.png?la=en&h=46&w=61&hash=9E59B2A17A07A2FA5C29A5E02E10EACF)

.png?la=en&h=49&w=49&hash=D18977C02B879EBCF0009A4BF4E03763)

.png?la=en&h=49&w=49&hash=EDD4136F3DB7BFD31614CA1442440B74)

About iz

What is iz?

Born out of a simple belief: Money is meant to be easy; iz is a youth banking app designed to streamline the banking experience. With an intuitive interface and user-friendly design, iz aims to be a trusted financial companion that eliminates the need for papers, queues, and hassle. Embrace a smarter way of banking with iz!

Why choose iz?

Inspiring a new and more liberated way of banking; iz targets youth segments which is ideal for users who are looking for a modern, slick and simple banking experience. iz offer its users a range of innovative and services that cater to their unique needs and preferences. Whether it's savings accounts, loans, bills or transfers, iz has got you covered.

What makes iz special?

Enabling you to live with more; iz is designed to simplify your life and give you more freedom. With a focus on students and young professionals, iz offers an array of features such as Qattah, student credit cards, savings goals, and much more. Experience a new level of ease and convenience with iz.

Frequently Asked Questions

You'll need the following:

- A valid commerce registration number owned by an individual.

- A valid National ID.

- A valid KSA mobile number

- Nafath authentication via Nafath mobile App.

- Personal and Business data including tax info, business income and number of employees.

Please note that registration only possible inside the kingdom of Saudi Arabia.